Main Menu > Financial Management > GST Reports > GST Return

This is the In-Built GST Return File Making Tool in RanceLab, wherein one can fill in some basic details & can generate multiple GST Return Files to upload them directly on the Government GST Portal.

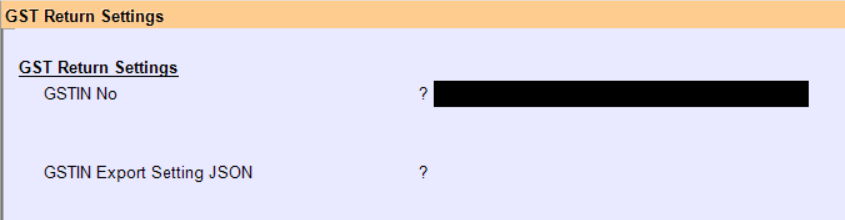

Above are the details that are to be filled.

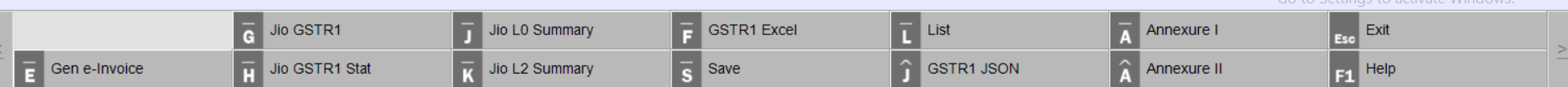

Below are the multiple files that can be generated from here and some other options are provided.

Process for GSTR1 return in RanceLab

1. Generation of GSTR1 in excel template as provided by the GSTN

It will allow you to generate the GSTR 1 in GSTN provided EXCEL template at the click of a button. You need to download and install the offline utility tool provided in GSTN portal.

To generate the GSTR1 file in excel format

●Go to Financial Management > GST Report > GST Return (FGG)

●Select GSTIN No from List. This list is based on the GSTIN defined in the location master. You may have the same GSTIN defined in multiple location. In that case, it will show a single number and when you select it will combine the reports of all related locations.

●In GSTIN Export Setting JSON field, enter JSON string with CURR-GT and GT value

○Example

{

"gt": "25000000",

"currgt": "2500000"

}

●Press Button “GSTR1 Excel(ALT+F)”

●Import the EXCEL file generated into the Tool provided by the GSTN portal and generate JSON file

●You are ready to upload the output (GSTR1 JSON file) on GSTN porta

In GSTR1 excel template, there are following sheets

●B2B - Taxable Outward supply made to registered person +Deemed Export +SEZ Developer

●B2CL - Taxable Outward supply made to Unregistered person +Interstate sale + Bill Amount > 2.5 lac

●B2CS - Taxable Outward supply made to Unregistered person +Local sale any bill amount +Interstate sale Bill Amount <=2.5 lac

●CDNR - Credit Note (sale return)/Debit Note/Refund Voucher Issued to the registered person during tax period

●CDNUR - Credit Note (sale return)/Debit Note/Refund Voucher Issued to the unregistered person against Interstate sale (B2CL and Export) + Bill amount >2.5 lac

●EXP - Export Supplies

●AT - Tax liability on Advance amount for which invoices have not been issued in the same tax period

●ATADJ - Adjustment of tax liability paid on advance receipt of previous period and invoices issued in the current period

●EXEMP - Details of Nil Rate, Exempted and Non GST supplies during the tax period

●HSN - HSN wise summary of goods/services supplied during the tax period

●DOCS - Details of various documents like sales, sales return etc issued during the tax period

2. Generation of GSTR1 in JSON file as required uploading in GSTN Portal directly

It will allow you to generate the GSTR1 in JSON format without the use of the tool provided by the GSTN portal.

To generate the GSTR1 file in JSON format

●Go to Financial Management > GST Report > GST Return (FGG)

●Select GSTIN No from List

●In GSTIN Export Setting JSON field, enter JSON string with CURR-GT and GT value

○Example

{

"gt": "25000000",

"currgt": "2500000"

}

●Press Button “GSTR1 JSON (CTRL+J)”

●File will be generated in default folder

●You are ready to upload the output (GSTR1 JSON file) on GSTN portal

GSTR1 Related FAQ

Why it is showing “Invalid Data” message while exporting a GST Return File from RanceLab?

Solution: You need to check the following points.

1. GSTIN No should be valid i.e. in correct format; it should be 15 digit alphanumeric codes

| First 2 digits | - State code |

Next 10 Digits - PAN No

| 13th digit | - any alphanumeric no |

| 14th digit | - Should be Z and in case of EGSTIN No it should be C |

| 15th digit | - any alphanumeric no |

2. HSC/SAC code should not be blank or none; it should be either 2 digit or 4 digit or 8 digit (for export) and numeric only.

3. State Code should not be blank, it should be 2 digits

4. IGST or CGST + SGST should be applied as per the place of supply

5. UQC (Unit Quantity Code) should not be blank; it should be as per the list provided by the GSTN. Example: BAG-BAG. BGS-BAGS, BOX-BOX, BTL-BOTTLES, KGS-Kilograms, LTR-LITERS, MTR-METER, PCS-Pieces

Why it is showing “Invalid Date” message while exporting a GST Return File from RanceLab?

The Date range must be always 1 month when you are exporting GST.

Remove checking of Sale memo reference in sale return during generating GSTR1

Scenario:

As per the GST rule ,sale memo no reference is not mandatory in sale return. At present we are checking for the Sale memo reference in sale return during GSTR1 generation

It is required remove this check and allow to show all sale return whether Sale memo reference is there or not

CDNR - sale return for B2B bills, against sale memo no not mandatory to generate GSTR1 now it is not showing in the report because we are checking for against sale memo no.

Exempt - sale return for B2B exempt bills Against sale memo no not mandatory to generate GSTR1,now it is not showing in the report because we are checking for against sale memo no.

New GST Return

Scenario:

Under the New GST Return System, there is one primary return proposed, called FORM GST RET-1, which will contain details of all supplies made, input tax credit availed, and payment of taxes, along with interest, if any. This return will have two annexures called FORM GST ANX-1 and FORM GST ANX-2.

GST ANX-1:

It contains details of all outward supplies, inward supplies liable to reverse charge and import of goods and services.

GST ANX-2:

It will have all the details of inward supplies.

This return will need to be filed on a monthly basis, except for small taxpayers who can opt to file the same quarterly. Small taxpayers are taxpayers with a turnover of up to Rs 5 crore in the preceding financial year.

Solution:

In GST Return (FGG) - add two Buttons.

●GST ANX-1

●GST ANX-2

With the help of this button, both the annexures will be generated in excel as per predefined formats shared by the GSTN.

Enhancement in GSTR1 Report based on updated GST Tool

In GST Return (FGG) - GSTR1 (ALT+F) - In Excel B2B section

We have added one more column "Receiver Name" i.e. customer name after "GSTIN/UIN of Recipient" column